In the past 6-9 months we’ve seen a dramatic shift in the market, driven by changes in our overall economy. Most notably, the interest rates have essentially doubled in that time causing many buyers to pull back in hopes of waiting for the rates to drop again. There’s good news! Inflation is clearly cooling, and rates are in fact dropping. And while by spring rates may be lower and there will be more homes on the market, I’m going to argue that right now, even before rates drop more, is a much better time to buy a home. Let me explain why I would suggest such a seemingly absurd action.

First a couple of caveats. I would never argue for someone to buy a home that doesn’t meet their needs. If today’s interest rates leave you only able to afford a one-bedroom when you need two or more for your family, wait until you can afford what you need. Similarly, don’t settle for something you don’t love, ever, no matter how good the deal. The deal isn’t good if the fit isn’t! The buyers I’m talking to now are those who can afford to buy with today’s interest rates but aren’t even looking because they await those lower rates.

Price, for anything, is driven by the laws of supply and demand. Both high demand and low supply will raise prices. The low supply of houses mixed with high demand is what caused the surge in housing prices in the past couple of years. That high demand caused great competition among buyers who offered huge amounts over asking. The economic downturn changed all this with rising interest rates putting a halt to the buying frenzy. My experience tells me that when interest rates lower, as they’re already starting to do, the underlying factors of low supply and high demand that led to the frenzied buying will not have changed..

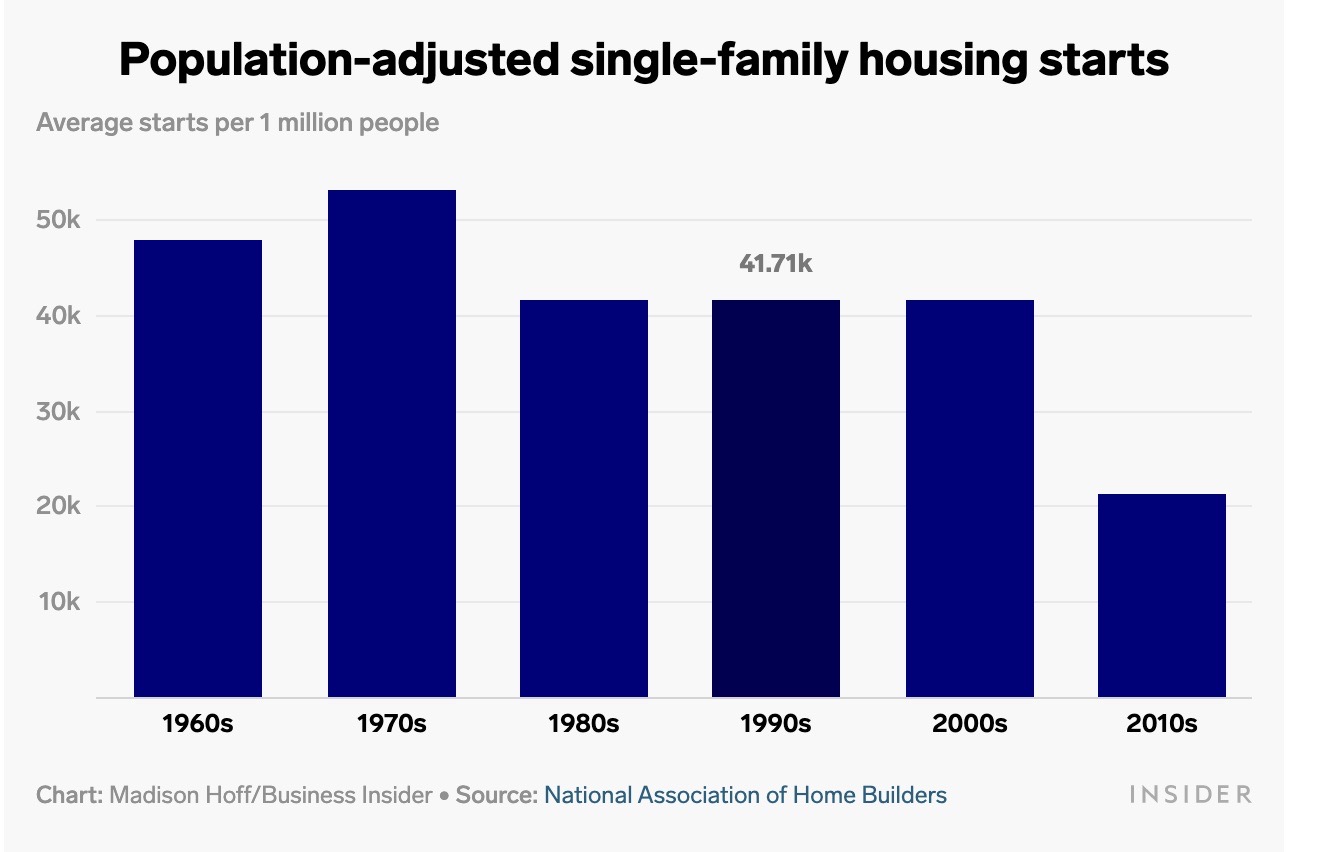

Let’s talk first about the issue of supply. Home starts, meaning the number of new homes beginning construction, declined severely after the lending debacle that led to the housing crash of 2005, as the chart below indicates.

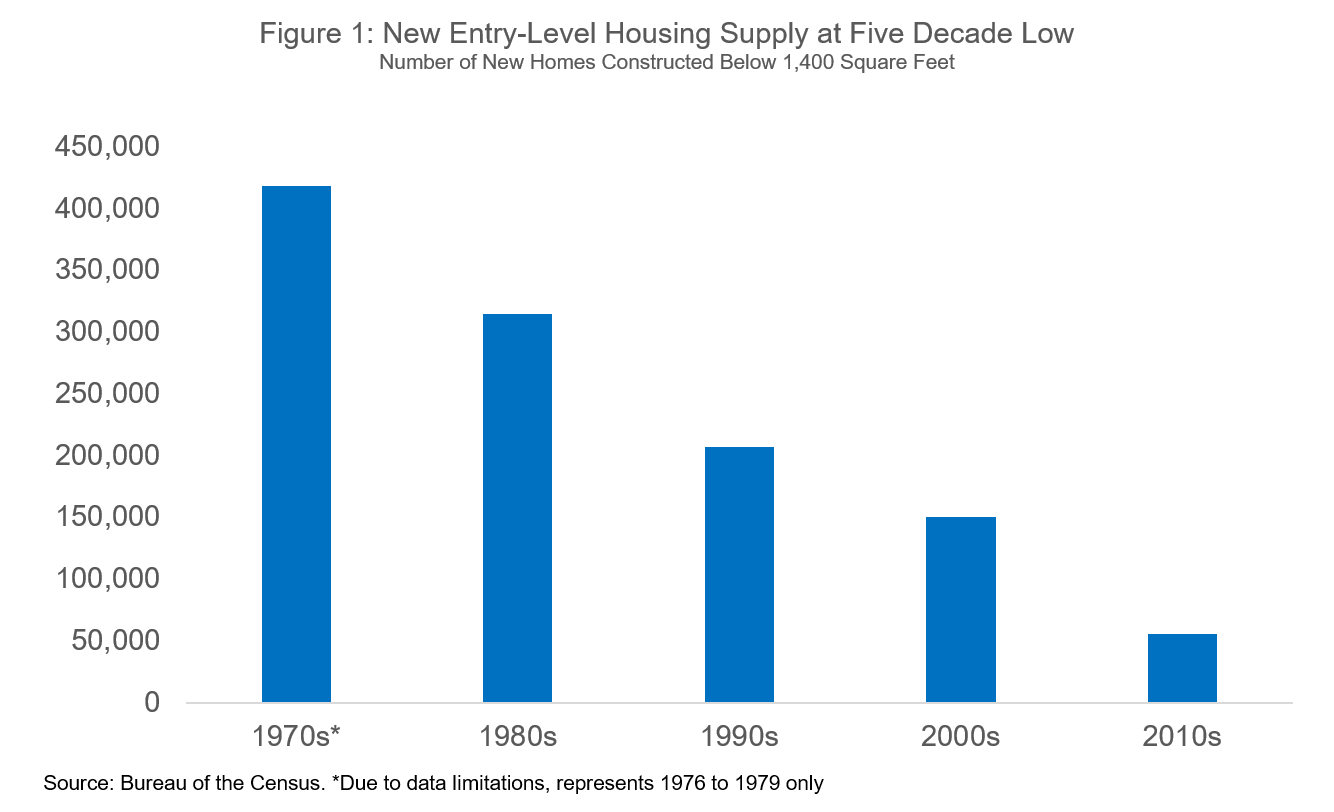

And, while the total number of housing starts shrank dramatically and have only begun rising slowly, the number of entry level home starts, i.e., affordable housing starts, have been on a steady decline since the 1970s, as seen in the next chart.

Over time, this has led to have an incredible shortage of homes. According to , in 2020 we were nationally at a shortfall of 3.8 million homes and not even building fast enough to meet new household formations, let alone begin to address this shortfall of homes. In Oregon last year, 36,000 new households were created, but only 20,000 new homes were built. According to Khater, nationally only half the number of homes needed throughout the 2010’s decade were built. There is a major shortage of homes in general, but in particular, affordable homes which make up only a small fraction of the homes built. The dirth of affordable homes is making it even harder for young people to buy their first home.

While the December numbers for homebuilders’ confidence are really encouraging for building in late 2023, it will fall below last year’s building number early in the year based on the lack of permit activity in the last quarter of 2022. Plus, the shortage is so big that it’s going to take well over a decade to make up for it.

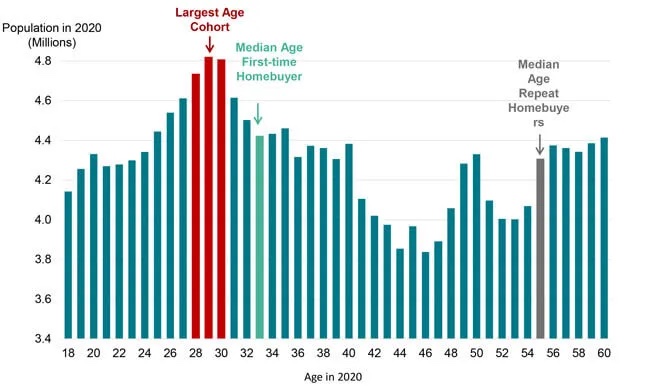

Now, let’s move to demand. First-time home buyers currently make up 45% of the home buyer population. That number IS going to increase because the demographic seeking their first-time home is comprised mainly of millennials. The chart below explains that the average age of a first-time home buyer is 33. Millennials are THE largest age cohort, outnumbering even those of us known as boomers. Starting next year the largest cohort within the Millennial population will reach 33. That group doesn’t significantly drop in numbers for about 10 years. This is where the increased demand is originating. And it’s not likely to slow for at least a decade.

My argument is that despite inventory fluctuations that may increase or reduce supply , the market will continue to have limited homes and high demand for the foreseeable future. This explains one thing that’s happened in the current market. When interest rates rose, the buyer pool went on vacation and homes prices dropped from this year’s peak in Portland. HOWEVER, the average home price in 2022 was still 6% over what it was in 2021. While a home could have sold for more 6 months ago, and in fact in December the average was lower than in Dec of 2021, you still have overall appreciation. That is not what you would expect in a low demand market. Forecasters are predicting a range of +4 to -4 for home appreciation in the coming year, depending on local factors.

Okay, so we have a long-term supply issue, and we have a first-time buyer flood headed in our direction. This means as rates fall, I would not be surprised to see a return to a competitive market with quick-selling homes receiving multiple offers over asking. And, I expect the market to stay that way for some time. Right now, you can get a home at asking and even some seller concessions. I expect that to change later this year. Yes, you might pay more in interest. But there are programs that let you buy down your interest rate for the first couple of years and then, when rates are lower you can refinance. Yes, refinancing will cost you money, but not as much as offering $25K or more over asking to get the home you want in a competitive market. That, my friends, is why I truly believe now is the time to buy, if you’re in a position to do so. Please reach out if you have any questions. And remember, these are my opinions, do your own research.

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link